UP Board Solutions for Class 10 Commerce Chapter 3 Bank Reconciliation Statement

Bank Reconciliation Statement Objective Type Questions (1 Mark)

Question 1.

When the balance as per cash book is the starting point, direct deposits by customers are:

(a) Added

(b) Subtracted

(c) Not required to be adjusted

(d) None of these

Answer:

(a) Added

Question 2.

A Bank Reconciliation Statement is prepared with the help of:

(a) Bank Statement and Bank Column of the Cash Book

(b) Bank statement and Cash Column of the Cash Book

(c) Bank column of the Cash Book and Cash Column of the Cash Book

(d) None of the above.

Answer:

(a) Bank Statement and Bank Column of the Cash Book

![]()

Question 3.

A debit balance in the depositer’s cash book will be shown as:

(a) A debit balance in the Bank Statement

(b) A credit balance in the Bank Statement

(c) An overdrawn balance in the Bank Statement

(d) None of above

Answer:

(b) A credit balance in the Bank Statement

Question 4.

A Bank Reconciliation statement is a ………….

(a) Part of Cash Book

(b) Part of Bank Account

(c) Part of Financial Statement

(d) None of these

Answer:

(b) Part of Bank Account

Question 5.

Bank ………… make payment on behalf of customers. (UP 2012, 17)

(a) can

(b) cannot

(c) not known

(d) all of these are incorrect

Answer:

(a) can

Question 6.

Bank reconciliation statement is prepared by: (UP 2015)

(a) Trader

(b) Bank

(c) Debtor

(d) Creditor.

Answer:

(a) Trader

![]()

Bank Reconciliation Statement Definite Answer Type Questions (1 Mark)

Question 1.

Write the name of the statement prepared for reconciling the balances of cash book and passbook? (UP 2014)

Answer:

Bank Reconciliation Statement.

Question 2.

Who is prepared a Bank Reconciliation statement?

Answer:

Trader or the Bank Account Holder.

Question 3.

Write the name of the book in which entry made by the bank.

Answer:

Pass Book.

Question 4.

Which type of transactions are entered into cash book?

Answer:

Cash transactions are entered (UPBoardSolutions.com) into cash-book.

![]()

Bank Reconciliation Statement Very Short Answer Type Questions (2 Marks)

Question 1.

What do you mean by Bank Reconciliation statement?

Answer:

The statement which is prepared to find out the reasons for differences in the balances of Cash Book and that of the Pass Book is known as Bank Reconciliation Statement.

Question 2.

What are the two methods of preparing the Bank Reconciliation Statement?

Answer:

There are following two methods of reconciling the bank balances:

- Bank Reconciliation Statement without preparation of Adjusted Cash Book.

- Bank Reconciliation Statement After the (UPBoardSolutions.com) preparation of the Adjusted Cash Book.

![]()

Question 3.

Write two importances of Bank Reconciliation Statement.

Answer:

- The reconciliation will bring out any errors that may have been committed either in the cash book or in the Pass Book.

- It helps in finding out the actual position of the bank balance.

Bank Reconciliation Statement Short Answer Type Questions (4 Marks)

Question 1.

Prepare a Bank Reconciliation Statement from the following particulars as on 31st March 2014: (UP 2015)

(i) Debit Balance as per Cash Book – Rs. 8,000

(ii) Cheques issued but not presented for payment – Rs. 1,880

(iii) Cheques deposited into the bank for collection but not yet collected by the bank – Rs. 2,000

(iv) Interest allowed by the bank – Rs. 80

(v) An insurance premium paid by the bank but no information is given to the customer – Rs. 800

(vi) Bank charges – Rs. 50

Solution:

![]()

Question 2.

Prepare a Bank Reconciliation Statement as on 31st December 2012 of Shyam Nandan, Kanpur from the following particular:

(i) Debit balance as per Cash Book on 31st December 2012 was Rs. 5,000.

(ii) A cheque of Rs. 1,000 was sent for collection but was not collected by the bank.

(iii) A cheque of Rs. 500 was issued but it was not presented for payment.

(iv) Rs. 125 credited in the Pass Book for interest was not entered into Cash Book.

(v) Rs. 500 of Insurance Premium was directly paid by the bank. (UP 2016)

Solution:

Question 3.

Explain any two reasons for the differences in the balances of the two books.

Answer:

Following two reasons for the differences in the balance as shown by the cash book and pass book are:

(i) Cheques issued but not presented for payment: As (UPBoardSolutions.com) soon as any person is issued a cheque by the customer of the bank it is recorded on the credit side in the bank column of the cash book. The same cheque is presented by the person after a duration of time. Thus, if in between this duration the balances are reconcilled there will be differences in the two balances.

(ii) Cheques deposited but not collected or credited by the Bank: As soon as the cheques are deposited in the bank, the customer debits the bank column of the cash book. This will lead to an increase in the balance in the Cash Book. The book will not increase the balance unless the amount is really received. The process of the collection takes some time and is during this duration the balances are compared there will be a difference in the two because of these cheques.

![]()

Bank Reconciliation Statement Long Answer Type Questions (8 Marks)

Question 1.

What is the Bank Reconciliation Statement? Explain its utility and describe the method of preparing it. (UP 2002, 09, 16)

Or

When and why is the Bank Reconciliation Statement prepared? Prepare a Bank Reconciliation Statement with the imaginary figures. (UP 2006)

Or

Why, when and by whom is Bank Reconciliation Statement prepared? Give a proforma of Bank Reconciliation Statement. (UP 2019)

Or

What do you mean by the Bank Reconciliation Statement? Why is it necessary to prepare this statement by the businessmen? (UP 2007, 10)

Or

What are the main objectives of preparing a Bank Reconciliation Statement? (UP 2008)

Or

What is the Bank Reconciliation Statement? Why is it prepared? What are various reasons for differences in the balances of Cash Book and Pass Book at any particular date? Describe. (UP 2011, 18)

Answer:

Bank Reconciliation Statement: Bank balance as shown by the cash book must tally with the balance shown by the passbook. It is quite often seen that the balances as revealed by the cash book and the passbook do not tally. These differences may arise due to numerous reasons. In order to tally the balances of bank column of cash book and the passbook, a statement is prepared (UPBoardSolutions.com) which is known as the ‘Bank Reconciliation Statement’. Thus, Bank Reconciliation Statement may be defined as “The statement which is prepared to find out the reasons of differences in the balances of Cash Book and that of the Pass Book is known as Bank Reconciliation Statement”.

![]()

Importance of Bank Reconciliation Statement: The various reasons for the preparation of Bank Reconciliation statement are as follows:

1. Cheques Issued but not Presented for Payment: As soon as any person is issued a cheque by the customer of the bank it is recorded on the credit side in the bank column of the cash book. The same cheque is presented by the person after a duration of time. Thus, if in between this duration the balances are reconciled there will be a difference in the two balances.

2. Cheques Deposited but not Collected or Credited by the Bank: As soon as the cheques are deposited in the bank, the customer debits the bank column of the cash book. This will lead to an increase in the balance in the cash book. The bank will not increase the balance unless the amount is really received. The process of collection of cheques takes some time. If during this duration the balances are compared there will be a difference in the two because of these cheques.

3. Bank Charges: The bank provides many services to its customers. It provides services like collection of dividends, collection of interest, etc. The bank charges some extra amount for these services. Thus bank balance is (UPBoardSolutions.com) reduced as this is debited from the customers account without giving an intimation. This reduces the bank balance and no entry is made in the cash book.

4. Direct Deposits by Customers: There may be some customers who may deposit the money directly into the bank. Thus, the bank balance is increased while the balance in the cash book is not adjusted, accordingly this causing a difference in the balance.

5. A collection made by the Bank on Behalf of Customer: The bank may collect dividend on shares, on government securities etc. on behalf of the customer. The bank credits the amount to the passbook. This increases its balance. While the balance of the cash book is undercast. Thus, the two balances will differ from each other.

6. Dishonour of Bill Discounted with the Bank: The customer gets the bill discounted from the bank before the due date but if on the due date it was dishonoured the bank will debit the amount and the passbook balance will be reduced whereas the cash book will remain unchanged. This will also lead to the difference in the balances.

![]()

7. Interest Charged and Allowed by the Bank: When there is overdraft, the bank may charge interest on overdraft. The bank, will record it on the debit side of the passbook. There will be no entry in the cash book to this effect unless some information is received by the bank, thus leading to a difference in the balances. The bank allows some interest on the amount deposited by the customer on a specific date but the customer is informed at a later date. The customer will not pass any entry to this effect in the bank column of the cash book. Hence, there will be a difference between the two balances.

The procedure of Preparing a Bank Reconciliation Statement: In order to prepare a Bank Reconciliation Statement, the following steps should be undertaken:

1. Selection of date: Select the date on which the reconciliation statement is to be prepared. It is advisable for the students that the last date of the month should be taken into consideration so that balances as revealed by the Cash Book and the Pass Book may be easily taken out.

2. Scrutinising of entries: The entries on the debit and the credit sides in the Bank column of the Cash Book are checked with the respective credit and debit sides in the statement relating to the period in question.

3. Grouping of items: The items which are left unticked should be grouped according (UPBoardSolutions.com) to their respective headings.

4. Placing of items: The remaining unticked items should be grouped under two main headings ‘Add’ and ‘Less’.

This grouping of items is of course based on a decision whether the student wants to start the reconciliation statement with the Cash Book Balance or the Pass Book Balance.

5. Copying of Statement: The Bank Reconciliation Statement should be copied into the Cash Book at the end of the month or it should be kept safely in a separate record.

![]()

Rules to be followed for Bank Reconciliation Statement: If the balance of Cash Book is given in the question and the Pass Book balance is to be scrutinised then the following items will be added:

- Cheques issued but not presented in the bank for payment till the end of the month.

- Amounts credited by the bank without giving intimation to the customer by the end of the month.

The following items will be subtracted from the given balance:

- Amounts debited by the bank in the account of the customer without giving any information to him by the end of the month.

- Amounts of credit which have been anticipated to be credited but no credit was provided by the bank till the end of the month.

If overdraft (balance) is given then ( – ) sign will be asserted before balancing figures and calculation will be done accordingly. If the balance of Pass Book is given in the problem and balance of Cash Book is asked, then

Add:

- Amounts debited by the bank in the account of the customer without intimating the customer till the end of the month.

- Amounts of credit which were expected to be credited but no credit could be given.

Less:

- Cheques issued but not presented in the bank for payment till the end of the period in question.

- Amounts credited by the bank without giving intimation to the customer (UPBoardSolutions.com) till the end of the month.

![]()

Specimen of Bank Reconciliation Statement

Question 2.

What are the reasons for differences in the balance as per Cash Book and as per Bank Pass Book? (UP 2002)

Or

What is a Bank Reconciliation Statement? Discuss the reason liable for the difference between the balance of Cash Book and Bank Pass Book? (UP 2003, 13)

Or

What is the Bank Reconciliation Statement? What are the reasons for the difference in the balance of Bank Column of Cash Book and the balance of Pass Book? Give eight reasons for the difference in their balance. (UP 2004)

Or

What is the importance of Bank Reconciliation Statement? Explain the causes of differences in the Cash Book and Pass Book Balance. (UP 2005, 10)

Or

What do you understand by the Bank Reconciliation Statement? What are the reasons for the difference in balance between Cash Book and Pass Book? What are the objectives of preparing Bank Reconciliation Statement? (UP 2005)

Answer:

Meaning and Importance of Bank Reconciliation Statement:

Bank Reconciliation Statement: Bank balance as shown by the cash book must tally with the balance shown by the passbook. It is quite often seen that the balances as revealed by the cash book and the passbook do not tally. These differences may arise due to numerous reasons. In order to tally the balances of bank column of cash book and the passbook, a statement is prepared which (UPBoardSolutions.com) is known as the ‘Bank Reconciliation Statement’. Thus, Bank Reconciliation Statement may be defined as “The statement which is prepared to find out the reasons of differences in the balances of Cash Book and that of the Pass Book is known as Bank Reconciliation Statement”.

![]()

Importance of Bank Reconciliation Statement: The various reasons for the preparation of Bank Reconciliation statement are as follows:

1. Cheques Issued but not Presented for Payment: As soon as any person is issued a cheque by the customer of the bank it is recorded on the credit side in the bank column of the cash book. The same cheque is presented by the person after a duration of time. Thus, if in between this duration the balances are reconciled there will be a difference in the two balances.

2. Cheques Deposited but not Collected or Credited by the Bank: As soon as the cheques are deposited in the bank, the customer debits the bank column of the cash book. This will lead to an increase in the balance in the cash book. The bank will not increase the balance unless the amount is really received. The process of collection of cheques takes some time. If during this duration the balances are compared there will be a difference in the two because of these cheques.

3. Bank Charges: The bank provides many services to its customers. It provides services like collection of dividends, collection of interest, etc. The bank charges some extra amount for these services. Thus bank balance is reduced as this is debited from the customers account without giving any intimation. This reduces the bank balance and no entry is made in the cash book.

4. Direct Deposits by Customers: There may be some customers who may deposit the money directly into the bank. Thus, the bank balance is increased while the balance in the cash book is not adjusted, accordingly this causing a difference in the balance.

5. A collection made by the Bank on Behalf of Customer: The bank may collect dividend on shares, on government securities etc. on behalf of the customer. The bank credits the amount to the passbook. This increases its balance. (UPBoardSolutions.com) While the balance of the cash book is undercast. Thus, the two balances will differ from each other.

![]()

6. Dishonour of Bill Discounted with the Bank: The customer gets the bill discounted from the bank before the due date but if on the due date it was dishonoured the bank will debit the amount and the passbook balance will be reduced whereas the cash book will remain unchanged. This will also lead to the difference in the balances.

7. Interest Charged and Allowed by the Bank: When there is overdraft, the bank may charge interest on overdraft. The bank, will record it on the debit side of the passbook. There will be no entry in the cash book to this effect unless some information is received by the bank, thus leading to a difference in the balances. The bank allows some interest on the amount deposited by the customer on a specific date but the customer is informed at a later date. The customer will not pass any entry to this effect in the bank column of the cash book. Hence, there will be a difference between the two balances.

Reasons Liable for the Difference between the balance of Cash Book and Bank Pass Book. The reasons liable for the difference may be summarised as below:

1. Cheques Issued but not Presented for Payment: As soon as any person is issued a cheque by the customer of the bank, it is recorded on the credit side in the bank column of the cash book. The same cheque is presented by the person after a duration of time. Thus, if in between this duration the balances are reconciled, there will be differences in the two balances.

2. Cheques Deposited but not Collected or Credited by the Bank: As soon as the cheques are deposited in the bank, the customer debits the bank column of the cash book. This will lead to an increase in the balance in the cash book. The bank will not increase the balance unless the amount is really received. The process of collection of cheques takes some time and if during this duration the balances are compared, there will be differences in the two because of these cheques.

3. Bank Charges: The bank provides many services like collection of dividends, collection of interest, etc. The bank charges some extra amount for these services. Thus, the bank balance is reduced as this is debited from the customer’s account without giving any intimation. This reduces the bank balance and no entry is made in the cash book.

![]()

4. Direct Deposits by Customers: There may be some customers who may deposit the money directly into the bank. Thus, the bank balance is increased while the balance in the cash book is not adjusted accordingly, causing (UPBoardSolutions.com) a difference in the balances.

5. Collection by the Bank on behalf of Customer: The bank may collect dividend on shares, on government securities etc. on behalf of the customer. The bank credits the amount to the passbook, and this increases its balance. While the balance of the cash book is undercast. Thus, the two balances will differ from each other.

6. Dishonour of Bill Discounted with the Bank: The customer gets bill discounted from the bank before the due date but if on the due date it was dishonoured the bank will debit the amount and the passbook balance will be reduced whereas the cash book will remain unchanged. This will also lead to the difference in the balances.

7. Interest Charged and Allowed by the Bank: When there is overdraft, the bank may charge interest on overdraft. The bank will record it on the debit side of the passbook. There will be no entry in the cash book to this effect unless some information is received by the customer leading to a difference in the balances. Similarly, the bank allows some interest on the amount deposited by the customer on a specific date but the customer is informed at a later date. The customer will not pass any entry to this effect in the bank column of the cash book. Hence, there will be a difference between the two balances.

Question 3.

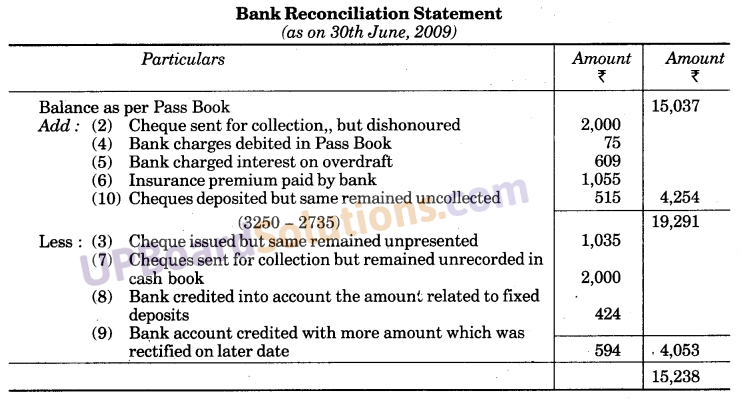

Prepare Bank Reconciliation Statement on 30th June 2011 as per the following information:

- The credit balance of pass-book on 30th June 2011 was Rs. 15,037.

- A cheque of Rs. 2,000 was sent for collection which was dishonoured.

- Cheques of Rs. 5,350 were issued for payment, but cheques worth Rs. 1,035 were presented for payment on 5th July 2011.

- Bank charges of Rs. 75 were debited in pass-book.

- Bank charged Rs. 609 as interest on overdraft.

- Bank paid Rs. 1,055 towards insurance as per standing instructions but Was not entered in the cash book.

- A cheque of Rs. 2,000 was sent for collection but was not entered in cash book by mistake.

- The bank credited Rs. 424 in the account related to fixed deposits (UPBoardSolutions.com) as per standing instructions.

- The bank credited Rs. 993 instead of Rs. 399 in the trader’s account by mistake which was rectified on 17th July 2011.

- Cheques of Rs. 3,250 were deposited for collection, but bank collected Rs. 2,735 only.

![]()

Solution.

Question 4.

Prepare a Bank Reconciliation Statement from the following particulars:

- On 31st December 2011, there was an overdraft balance of Rs. 13,880 as per Pass Book.

- Bank charged interest of Rs. 240 on overdraft for 6 months on 31st December 2011. This was not recorded in the Cash Book.

- Bank expenses of Rs. 60 are not recorded in the Cash Book.

- A cheque amounting to Rs. 2,300 was issued but not (UPBoardSolutions.com) presented for payment.

- Rs. 4,340 cheque was sent to the bank but was not collected and deposited.

- A bill of Rs. 1,000 which was discounted with Bank in November 2011 was dishonoured on 31st December 2011.

![]()

Solution:

Bank Reconciliation Statement on 31st December, 2011

Question 5.

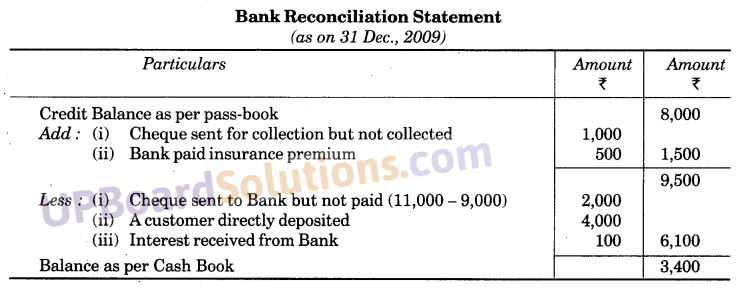

From the following particulars, prepare Bank Reconciliation Statement as on 31st December 2009:

On 31st December 2009, the passbook of Gaurav Khemka shows the credit balance Rs. 8,000. On comparing a cash book with a passbook, the following differences are found:

(i) Cheques sent to the bank for collection but not yet collected Rs. 1,000.

(ii) Cheques of Rs. 11,000 issued but out of them only cheques of Rs. 9,000 were presented for payment

(iii) Direct deposited by the customer in his bank account Rs. 4,000.

(iv) An insurance premium paid by bank Rs. 500.

(v) Rs. 100 has been credited by the bank. (UP 2010)

Solution:

Question 6.

From the following particulars prepare a Bank Reconciliation Statement as on 31st March 2007. The credit balance as per bank Pass Book on this date was Rs. 20,500:

(i) Out of total cheques of Rs. 2,000 issued during the month, cheques of Rs. 500 were presented for payment in May 2007, while a cheque of Rs. 100 was lost in transit.

(ii) In accordance with standing instruction of account holder, Bank paid LIC premium of Rs. 600 for which no entry was made in the Cash Book.

(iii) A customer directly deposited Rs. 2,000 in the bank for which no entry was recorded in Cash Book.

(iv) Bank charges of Rs. 50 debited into Pass Book were not recorded in Cash Book. (UP 2008)

Solution:

![]()

Question 7.

Prepare a Bank Reconciliation Statement as on 31st December 2008 on the basis of the following information:

(i) Bank Account balance as per Cash Book was Rs. 18,000 on 31st December 2008.

(ii) The cheque for Rs. 2,500 was sent to the bank for collection but was not collected.

(iii) Cheques for Rs. 4,000 and 3,000 were issued to creditors but the only cheque for Rs. 4,000 was presented for payment.

(iv) Following transactions were entered into Pass Book but Cash Book was left unrecorded:

(a) Bank Charges Rs. 50.

(b) Rs. 200 were paid for Insurance premium.

(c) Rs. 5,000 were deposited in the Bank Account directly by a customer. (UP 2009)

Solution:

Question 8.

From the following information, prepare a Bank Reconciliation Statement as on 31st December 2010:

(i) Balance as per Cash Book Rs. 8,000.

(ii) Cheques of Rs. 11,000 sent to the bank for the collection were not collected.

(iii) Cheques of Rs. 12,000 were issued but only cheques of Rs. 10,000 were presented for payment.

(iv) Rs. 4,000 was directly deposited into a bank by a customer.

(v) Rs. 500 was credited by the bank for interest.

(vi) Insurance premium was paid by the bank Rs. 1,500. (UP 2011)

Solution: